South Florida CRE Weekly - February 06, 2026

Commercial Real Estate Insights

February 6, 2026

Market Overview

The South Florida commercial real estate market is experiencing a surge in financing, with multiple large-scale refinancing deals and construction loans being secured. Despite higher interest rates, lenders are still investing in the region, particularly in multifamily and development projects. This trend is expected to continue, driven by the area's growing population and demand for housing.

Market News & Analysis

The Real Deal • 2026-02-05

Wynwood Plaza developers score $335M refi from Blue OwlThe refinancing of Wynwood Plaza is a significant indicator of the South Florida commercial real estate market's strength, with lenders willing to invest in large-scale projects despite higher interest rates. This deal is expected to have a positive impact on the local economy and demonstrates the area's attractiveness to investors.

Yahoo Entertainment • 2026-02-03

NHL Star Sam Reinhart Scores MLS's Sergio Busquet's $9 Million Florida MansionThe construction loan secured by 13th Floor Investments and Rockpoint for their rental project near the Boca Raton Tri-Rail station is a notable example of the growing demand for multifamily housing in South Florida. This project is expected to capitalize on the area's transit-oriented development trend and provide a significant boost to the local rental market.

The Real Deal • 2026-02-02

13th Floor, Rockpoint score $100M construction loan for rental project near Tri-Rail stopThe joint venture between 13th Floor Investments and Rockpoint has secured a significant construction loan for their transit-oriented rental project in Boca Raton, demonstrating the area's appeal to developers and investors. This project is expected to contribute to the growth of South Florida's multifamily market and capitalize on the region's strong demand for housing.

Featured Properties (5)

Havana Flex Residences

601 SW 6th Ave, Miami, FL 33130

Size: 2,496 SF • Market: Miami

- Prime central Miami location -Walkable cultural spots, strong restaurant corridor -major employment centers

Analysis: The Havana Flex Residences is an attractive investment opportunity due to its prime location in central Miami, with walkable cultural spots and strong restaurant corridors. The property's multifamily designation and relatively small size of 2,496 SF make it an ideal option for investors looking for a manageable and high-potential asset. Its proximity to major employment centers also enhances its rental income prospects.

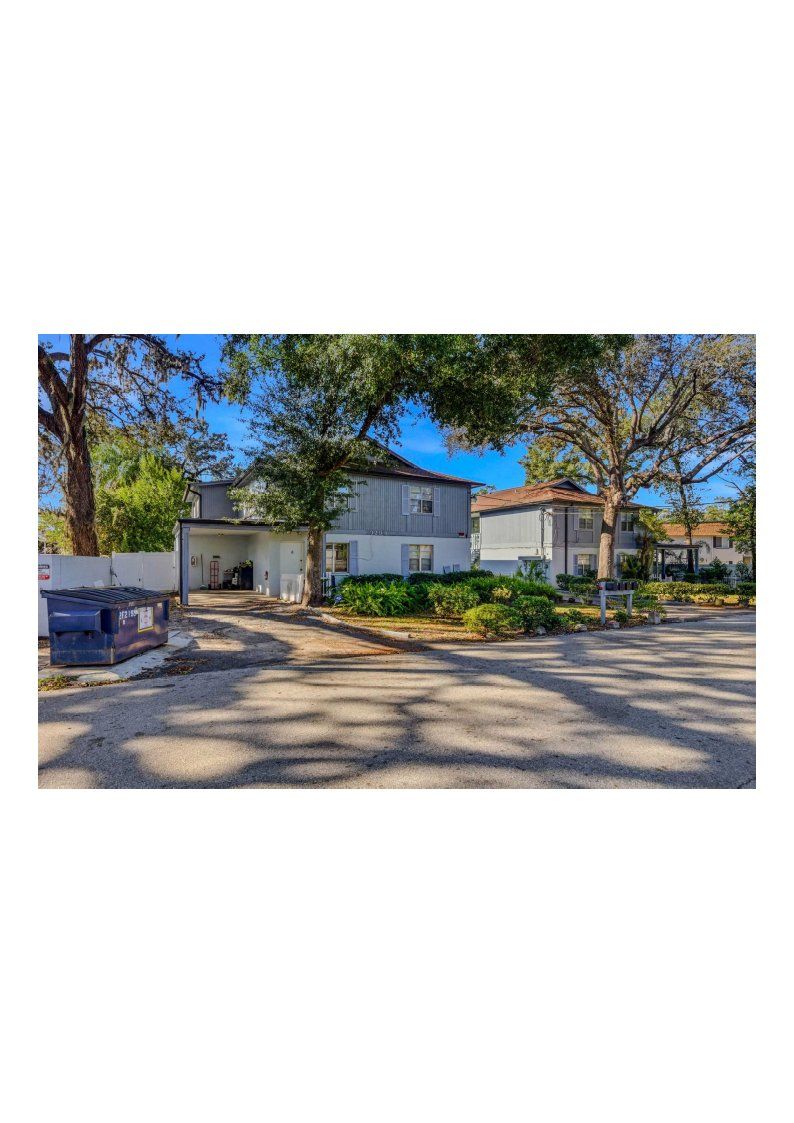

Terrace Park Apartments

9208 North Connechusett Road | Tampa, FL 33617

Size: 8,732 SF • Market: Tampa

- turnkey, income-producing asset

- 8-updated apartments

- minutes Busch Gardens, and just south of the University of South Florida

Analysis: The Terrace Park Apartments offer a turnkey, income-producing asset with 8 updated apartments, making it an attractive option for investors seeking a hassle-free investment. The property's location near Busch Gardens and the University of South Florida provides a steady stream of potential tenants, and its size of 8,732 SF presents opportunities for rental income growth.

Bowery I Development Site

140 Northwest 8th Avenue | Miami, FL 33128

Size: 45,000 SF Lot • Market: Miami

- Build 115 Units by right

- Potential to Build 273+ with Live Local

- Brickell, Downtown Miami, Wynwood Views

Analysis: The Bowery I Development Site presents a unique opportunity for developers to build up to 115 units by right, with potential for expansion to over 273 units with Live Local. The site's location in Miami offers stunning views of Brickell, Downtown Miami, and Wynwood, making it an attractive option for investors looking to capitalize on the area's growing demand for housing.

Miami River Development Site

690 Northwest 3rd Street | Miami, FL 33128

Size: 44,989 SF Lot • Market: Miami

- Build 155 Units by Right

- Almost

- double with live local

- Over an acre of land near Miami River

- Over $850,000 in Gross Income

Analysis: The Miami River Development Site offers a rare opportunity to develop a large parcel of land in a prime Miami location, with the potential to build up to 155 units by right. The site's proximity to the Miami River and its size of 44,989 SF make it an attractive option for developers and investors looking to capitalize on the area's growing demand for housing and commercial space.

Paradise on 3rd

1320 Southwest 3rd Street | Miami, FL 33135

Size: 5,033 SF • Market: Miami

- 5 Units located in the heart of Miami

- Balanced unit mix

- On-site parking

- 40-Year Certification Recently Completed

Analysis: Paradise on 3rd is an attractive investment opportunity due to its location in the heart of Miami, with a balanced unit mix and on-site parking. The property's recent 40-Year Certification completion enhances its value, and its size of 5,033 SF presents opportunities for rental income growth and long-term appreciation.

Looking to Buy or Sell in South Florida?

Get expert guidance on your next commercial real estate transaction.

Contact Us Today